In the story below, we delve into several lessons learned from a batch of BP documents leaked to us this week. The package was sent to creative agencies tapped as candidates to work on the oil major’s rebranding efforts and it lays out a “new” strategy that sounds an awful lot like Beyond Petroleum 2.0.

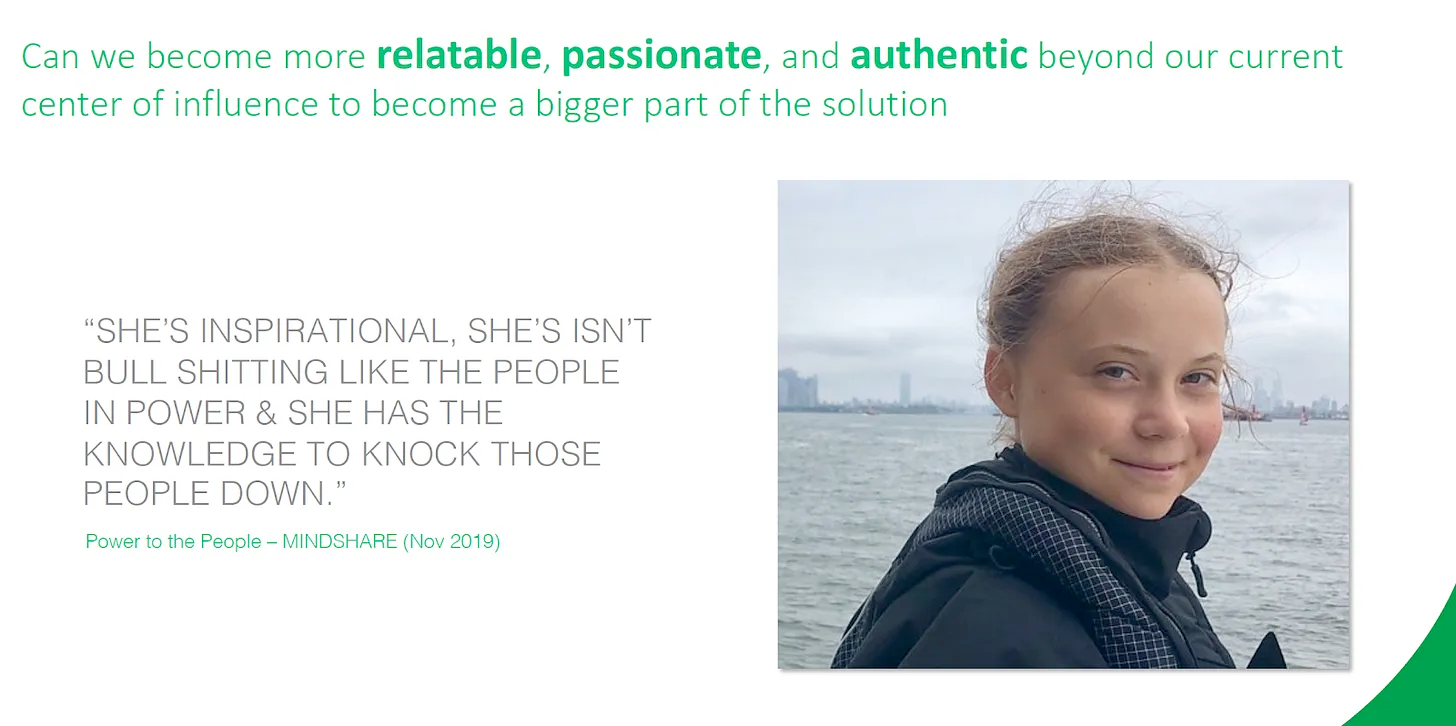

But there’s a silver lining in there and it’s this: the youth climate movement is really starting to get to these guys. BP clearly feels like it must at least try to do something to lower emissions. And yes that’s partly to do with the fact that it’s headquartered in a country that’s still signed on to the Paris Climate Agreement, but there’s nothing in this brief about that agreement or regulations or even the global energy market; there are five pages about the climate movement, and as many more about the need to get Gen Z to like them. Climate justice is mentioned, climate strikes, and the oil industry’s image as a “bad guy.”

That’s important for a few reasons. Protest has brought the climate movement some of its biggest wins in recent years. The Standing Rock protests, although they couldn’t stave off construction entirely, may ultimately prove successful at blocking the Dakota Access Pipeline, and were undeniably successful in drawing national attention to the impacts of pipelines crisscrossing the country and encouraging further protest. Youth climate strikes have put the climate issue back to the top of voters’ lists and the covers of magazines.

Which is why the current threats toward protest are quite worrisome. Whether we’re talking about the police brutality against peaceful protestors across the nation right now, or oil and gas states moving to criminalize protest, we’re getting dangerously close to losing one of the most effective tools in the justice toolbox.

As a premium subscriber, you get early access to the story in full, including a link to the leaked documents, now. Thank you for your support! In addition to backing our reporting, you’re helping to subsidize access to stories like this for all.

Is BP Really Changing? Or Is Its New Climate Message Just “Beyond Petroleum” All Over Again?

By Amy Westervelt

Bernard Looney has had a pretty wild first six months as the new CEO of BP. Just two months after taking the helm of the world’s fifth largest oil major, an international price war spilled over into a global pandemic, sending the price per barrel of oil into negative numbers for the first time ever.

Before all that, Looney had been gearing up to take on the issue everyone presumed would dominate his first few years: climate change. Or to put a finer point on it: balancing the need to act on climate change, or at least appear to be acting on climate change, with continuing to pay shareholders the dividends they expect. BP is on the hook for about $8 billion in dividends a year. The pandemic makes it that much harder to balance the two, but Looney is still talking as though leading the world’s transition to cleaner energy is his primary goal. Let’s take a closer look.

Looney’s repositioning of BP started with a February announcement that BP would achieve “net zero” carbon emissions by 2050. He also said that he planned to end the firm’s controversial “Keep Advancing” and “Possibilities Everywhere” ad campaigns, and swore off putting a fake green sheen on the company’s image forever more. These ads had been the focus of a suit filed in December 2019 against BP by the environmental law non-profit Client Earth, accusing the company of misleading consumers about not only its efforts to reduce emissions, but also the climate benefits of natural gas, and the need for it alongside renewables.

Looney was vague on any other details around the net zero pledge, though, making a few comments about carbon capture and offsets before announcing that he’d have a detailed plan by September, some nine months after the initial announcement. But that delay hasn’t stopped BP from advertising the hell out of its net-zero commitment.

The pandemic has affected BP for the worse, of course, same as every other oil major. But Looney remains on message about his quest to establish BP as the leader of the global energy transition. In a package of re-branding materials dated January 2020 and leaked to Drilled News, the company lays out its strategy, one that leans heavily on the phrase “energy transition.”

Looney has stuck to that strategy, which in some ways happens to dovetail with the changes needed to deal with the pandemic, such as cost-cutting and getting better at digital operations. In a May email to employees , Looney announced that he was cutting an entire layer of managers from the company payroll and slashing the company’s budget by 25%, with more cuts expected throughout the year. But Looney also told employees that BP would follow through on his original commitment to invest $500 million into renewable energy. Since the company’s remaining budget for the year is $12 billion, that doesn’t represent a significant re-orientation of the company’s portfolio.

So Looney is still talking about the rewiring of the globe’s energy system from dirty to clean as an opportunity worth trillions of dollars, and climate change as the most pressing crisis of our time. But he also continues to hammer the industry’s party line that its core products, which are among the leading causes of climate change, aren’t going anywhere. And it’s clear in a videotaped talk with employees, shared with Drilled News along with the strategy document, that while climate change might represent a moral imperative and a financial opportunity for the company, the priority no matter what is shareholder profits. “We’re probably going to be in oil and gas for decades to come,”Looney says in the video, “because how else is that $8 billion dividend going to get serviced?”

This package, which BP sent to creative agencies working on the company’s rebranding effort, makes it very clear that a lot of the ad campaign issues Client Earth sued BP over are very much a part of the company’s new “energy transition” strategy. It celebrates successes in connecting natural gas to renewables in the public’s mind, for a start, and when BP and Looney talk about “low carbon” energy, it’s clear that what they mean is natural gas. Which would make Looney’s recent comments about how we may have already hit peak oil — the point at which demand is just on a permanent decline — less of a breakthrough than they seemed.

I’ve gleaned six other key insights into BP’s intentions about tackling climate change from these materials:

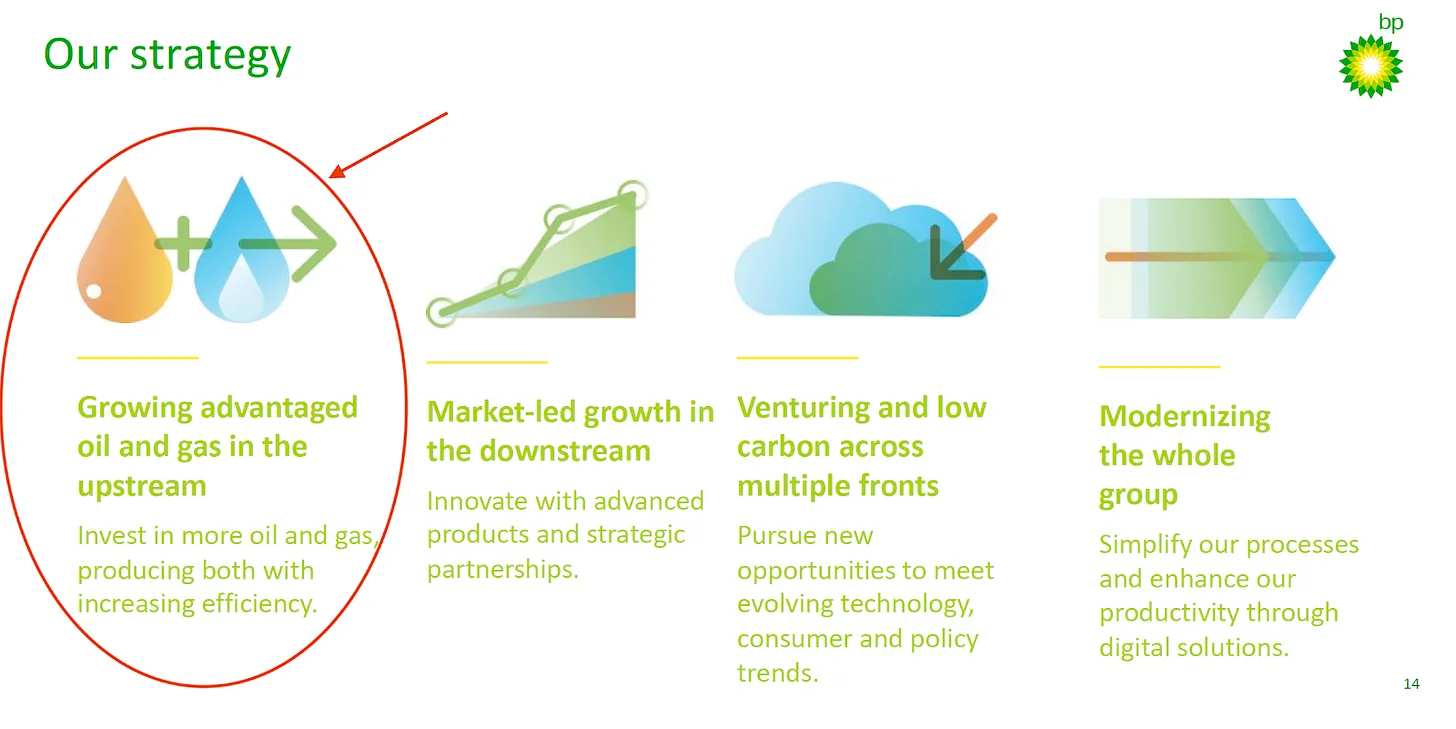

2. For all the talk of making a big transition, BP in fact still plans to grow its oil and gas business. According to scientists, the only way to keep warming below 2 degrees C (3.6 degrees F) and stave off the most catastrophic impacts of climate change is to stop new development of fossil fuels entirely, and ratchet down the use of existing stores. But for all its talk of energy transition, BP plans to “invest in more oil and gas” … and yet somehow get to net zero emissions.

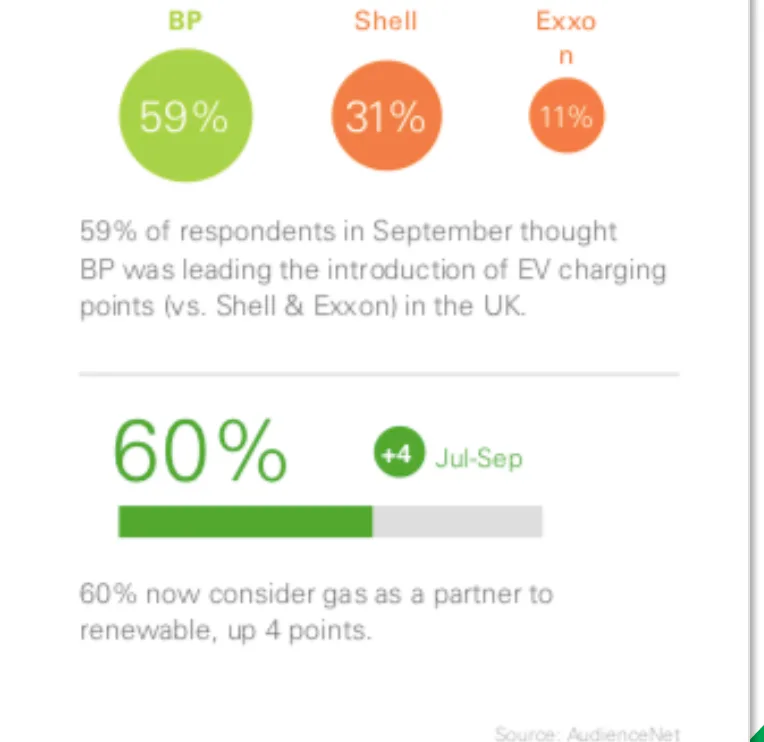

3. For BP, low-carbon includes natural gas, so the firm is deliberately trying to tie this fossil fuel to renewable energy. The fact that a full 60% of the public now associates natural gas with renewables — up four points! — is something that BP finds encouraging in its continued efforts to upgrade and burnish its reputation. (Folks, natural gas is a fossil fuel with intense greenhouse gas emissions.) Elsewhere in the deck, a graphic envisioning the company’s energy mix under a “transition to a lower carbon and digitally enabled future,” there is not a picture of a windmill or a solar panel, or even a nuclear plant, but of a natural gas refinery. It’s a neat trick: When your fuel of choice is methane, make everything about ‘net zero’ carbon emissions instead of actual zero emissions.

4. A key part of BP’s strategy is to convince the public that oil companies are the ones best equipped to manage the energy transition. The American Petroleum Institute went with “we’re on it,” Chevron’s staff are “problem solvers,”, ExxonMobil is “powering progress.” Now BP wants you to know that it “gets it.” Because if they can convince us that they’re solving the problem, who needs regulation, activism, competing clean energy companies — really any external pressure at all?

5. The climate movement has debunked fossil fuel’s fairy tales. In the wake of 2010’s Deepwater Horizon oil disaster in the Gulf of Mexico, it was a top BP manager, executive vice president Dev Sanyal, who first formally documented that the fossil fuel industry’s ongoing existence relies heavily on having a “social licence to operate,” meaning approval from a majority of the public and other stakeholders. It’s clear in this creative brief that the climate movement, particularly the work of youth climate activists, has begun to erode that license. And that’s deeply concerning to oil companies. There are more pages on the climate movement in this presentation than on anything else.

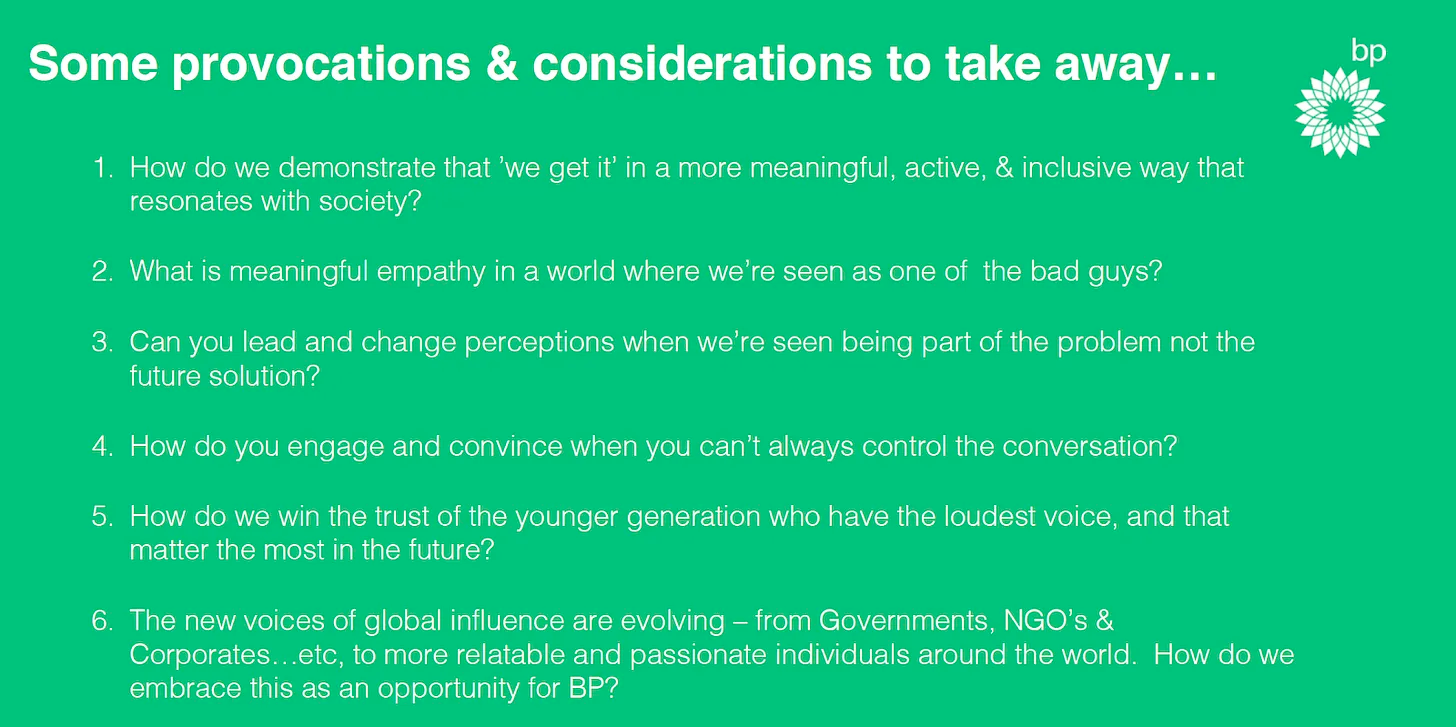

6. BP is still a master of spin. From the people who brought us “Beyond Petroleum,” I bring you: “What is meaningful empathy in a world where we’re seen as one of the bad guys?” Clearly not a marketing slogan, but certainly it’s about perception, about changing just enough to maintain that social license but not so much that dividends decrease. BP wants to portray itself as leading the “energy transition” while still taking pride in being salt-of-the-earth oil and gas guys. Said Looney himself, in his talk to employees, “We’re probably going to be in oil and gas for decades to come, and I’m good with that, I’m proud of that. But I think we have to get out there and be honest with people. We’re in oil and gas. The world needs it. And better BP does it than someone else, I firmly believe that.”

Oil majors in countries that have signed on to the Paris Agreement on climate are under more pressure to take the ideas of emissions reductions and an energy transition seriously. That’s why we’ve seen these “net zero” announcements from BP (headquartered in the United Kingdom) and Shell (wholly owned by Netherlands-based Royal Dutch Shell), but not Chevron or ExxonMobil.

It’s also why despite pandemic-driven global economic meltdown, BP is still investing just over 4% of its budget this year — that $500 million Looney committed to— versus the roughly 1% that Exxon and Chevron invest in their “green” initiatives.

But if you go beyond the messaging to what BP is actually doing — growing its oil and gas business, investing in petrochemicals, doubling down on natural gas as necessary to any clean energy transition — it seems clear that the role it desperately wants, that of leader of the world’s energy transition, the only company suited to a task so monumental and important, is one it’s neither suited for nor prepared to take on in good faith. The intention may be there, and Looney can certainly talk the talk better than any oil exec we’ve ever seen. But when it comes to climate action, BP still just doesn’t “get it.”